Advance Monthly Procedures

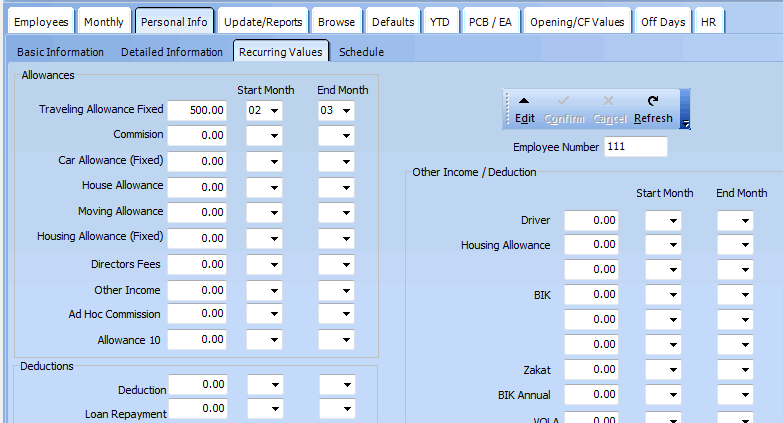

1. Recurring Allowances and Deductions

On this screen, you can add recurring payments for Allowances, Deductions and Other Income. Other income refers to items like Benfit in Kind and other income not paid together with the monthly salary.

Click Edit.

Enter the amount and “Start Month” and “End Month”. If Start/End Month is not included, the recurring payments will be added for all months of the year.

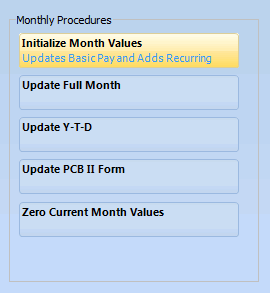

There are two ways to add Recurring payments to your monthly calculations.

1. Initialize Month Values. This will automatically update all employees with recurring payments and basic pay. It is recommended to this before starting new month calculations.

2. Click Reset Month. This will reset all the Allowances / Deductions and Other Income and Basic Pay. All other values including Overtime is not affected.

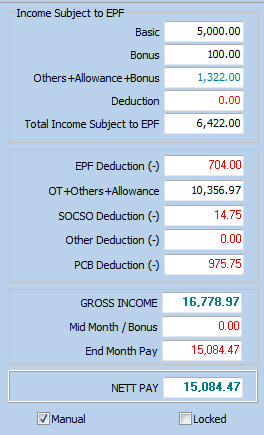

2. Manual Calculations

There are times, when it is necessary to override the automatic EPF, SOCSO and PCB calculations. This can be due to special circumstances or to enter data from previous month calculations that were done manually.

To do this Edit / Click on the “Manual” Check box / Confirm.

In “Manual” Mode, the software will suspend all automatic calculations and will do addition and subtraction based on this column only. All Allowances, Deductions, Overtime and other income will be ignored. “Red” items are deductions.

3. Prorated Work Days

This software does not have a function to calculate prorated work days. To calculate prorated work days, use the following formula and add as a deduction

[Monthly Salary)/ (Days in the Month] x (Days not Worked)

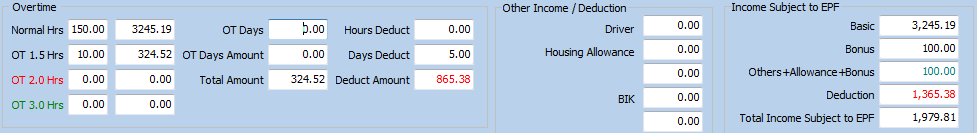

4. Daily Rated Employees

It is possible to do calculations for daily rated employees by using the “Normal Hrs” field in the overtime table. When there is a value for “normal” hours, the basic pay will be based on the normal hour calculations and override the monthly basic pay. The hourly rate will be based on the “Basic Pay” or alternatively The “Hourly Rate” set in the personal info screen.

5. Memo Field

At the bottom of the monthly screen is “Memo” field. Any comment entered here will appear at the bottom of the payslip. This field can be used to “pass a message” to the employee or the explain any special calculations / payments that were made in calculating the monthly salary.

6. Locked

Next to the manual check box is a “Locked” check box. This check box will be checked after the YTD calculations are done. This to prevent user from accidentally recalculating after changes have been made. This feature can be overridden by “uchecking” Locked. Once unlocked, data can be edited and recalculated again.

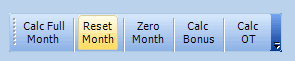

7. Zero Month

Zero Month will set all values to zero including allowance, deduction and overtime. You can then click on “Reset Month” to add back the default values.

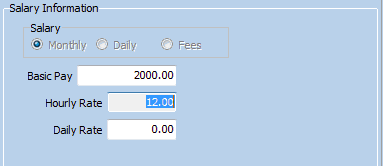

8. Daily Rate

The default daily rate is set in the Company Defaults screen. The legal default hourly rate value is (Basic Salary) / 26 / 8. It is okay to use a higher hourly rate, e.g. (Basic Salary / 22/ 9), but not a lower hourly rate. This legal rate only applies to staff fulfilling the criteria as stated in the Employment Act.

The Act covers the following:

- Employees whose monthly wages is less than RM1,500 (excluding overtime, commission or allowances)

- Employees engaged in manual labor, skilled or unskilled (irrespective of amount of monthly wages)

- Employees engaged in operation/maintenance of motorized vehicles

- Employees continuously supervise other employees in manual work

- Engaged as domestic servant.

The hourly rate for all other staff is based on terms set out in the employment contract. To calculate overtime for these staff, enter the “Hourly Rate”. The hourly rate value will override the “Basic Salary” amount for overtime calculations.

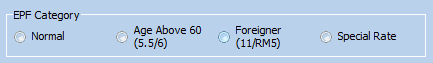

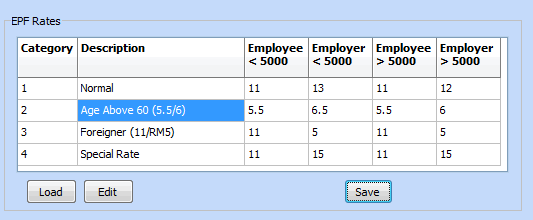

9. Customised EPF contributions

There can be cases, where the employer wishes to pay a higher EPF amount, especially for staff above 60. Either create a special rate or change the values for Employees age above 60. The changes can be seen on the Employee profile page.

Employees aged 60 years and above, up to 75 years has been revised as of September 2013

From EPF website :

The EPF’s new contribution rate in line with the minimum retirement aged of 60 years will be effective from August 2013 salary/wage (September 2013 contribution).Cumulative contribution rate for those aged between 60-75 years, is half (50%) of the statutory contribution rates for both employees and employers stipulated above;