Actpay Lite salary calculator is a basic payroll software for Malaysian small businesses. This software is targeted at users who are currently using Excel to do their payroll calculations. This software simplifies and speeds up the data entry process by showing all details on one screen for faster an more accurate calculations.

Actpay Lite Salary Calculator Features :

- Accurate Government Statutory Calculations for EPF, SOCSO, EIS and PCB.

- Basic overtime calculations using OT Rate.

- Allowances, Deductions and Benefit in Kind for PCB Calculations.

- 6 Allowances, 3 Deductions, Benefit in Kind and Zakat.

- Print and view individual payslip and monthly summary.

- Export full calculation data to Excel for custom reports.

- No staff limit.

For full payroll with extensive reports and functions please go to actpayroll.com.

Installation Procedure

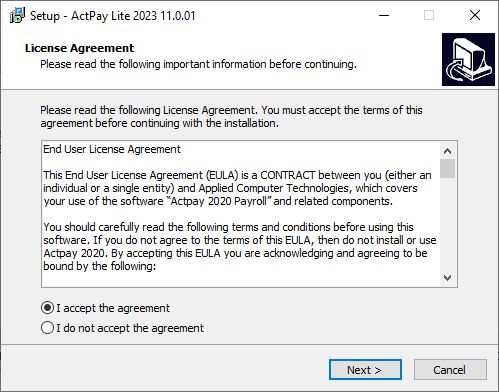

Download and run SetupActPayLITE-23-01.exe

Accept agreement and click Next

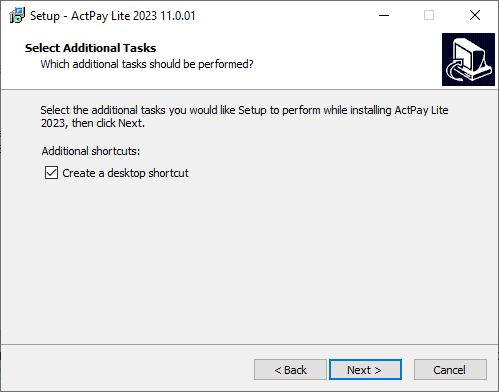

Continue and Click next for the next 2 screens.

Installation Done. Click Finish.

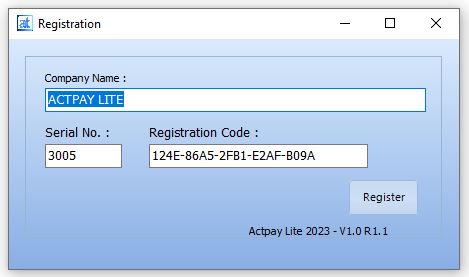

Please enter Company Name, Serial No. and Registration code. This information will be sent to you by Email. Note that company name will appear in Payslip and Summary report and cannot be changed.

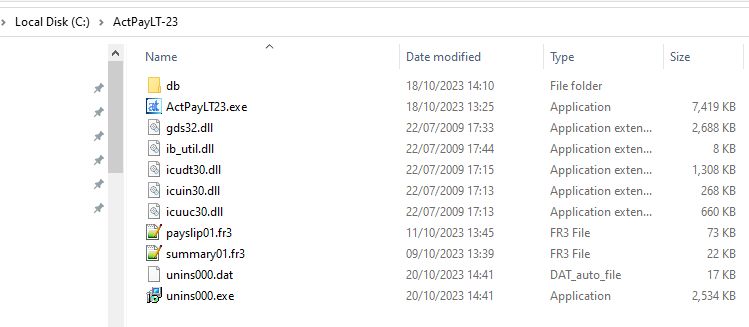

Salary Calculator Software will be installed in the C: drive as seen below. You can copy the folder and run it anywhere else.

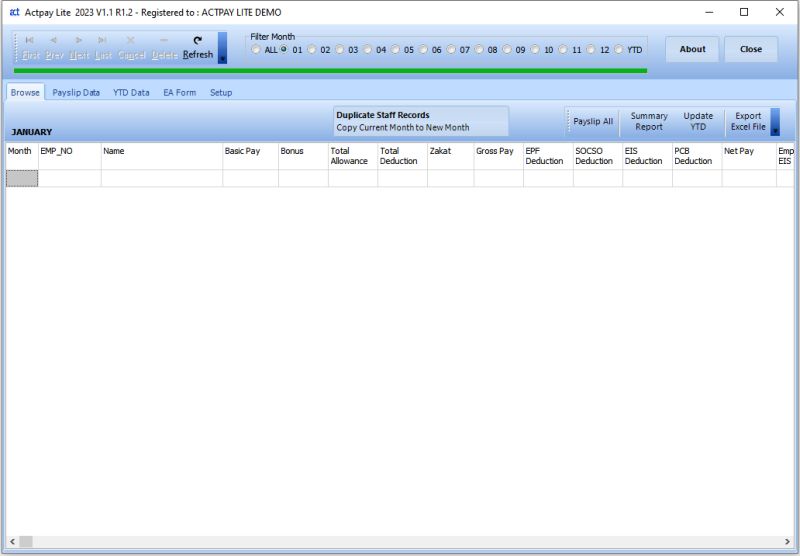

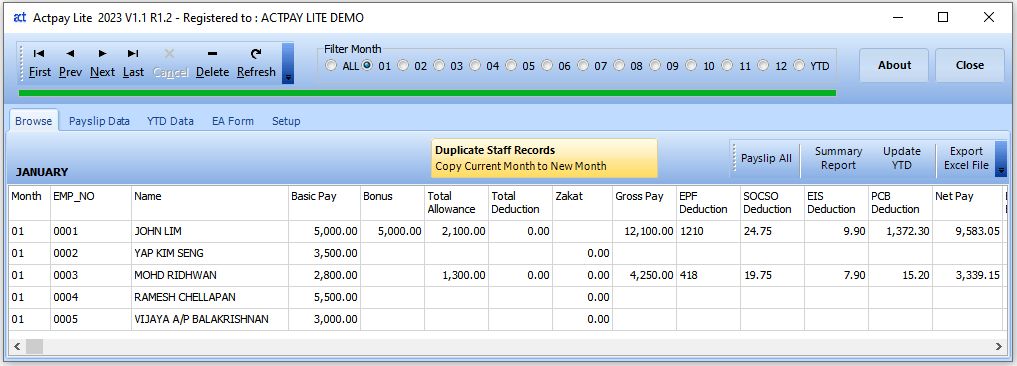

Actpay Lite Opening Screen

When you first start the salary calculator software, the staff screen will be empty. This screen will show the list of Employees after you have added the staff details.

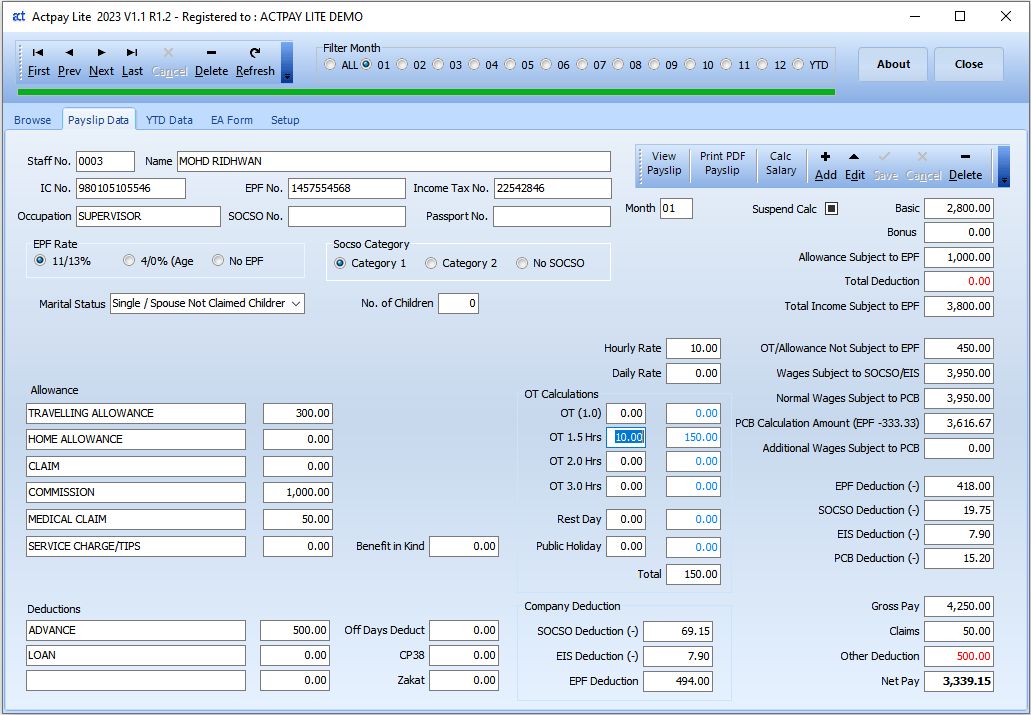

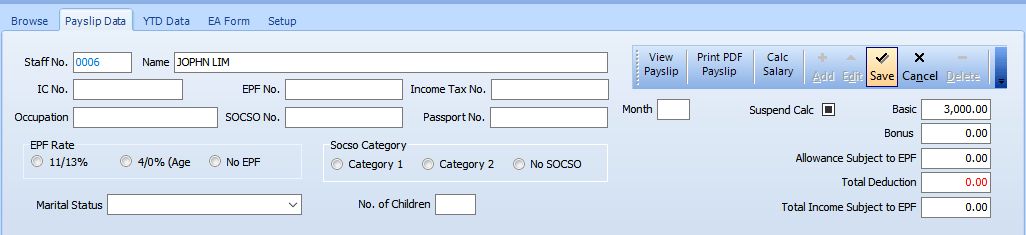

Data Entry Screen

Enter new staff. Do add click “Add”

For accurate reports, each staff must have a unique Staff No. All other fields are optional. If nothing else is added, the default settings for EPF, SOCSO and PCB wiill apply

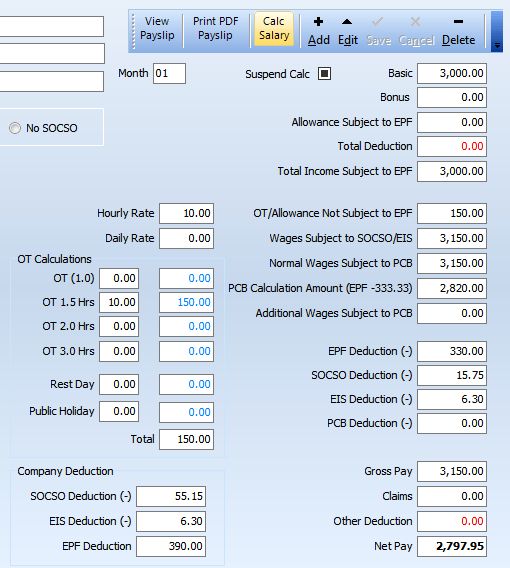

In the example below, Staff No., name, basic and overtime have been added. Click Save to save this new staff details. Other information like IC, EPF number and income tax number are optional. If you will be using the Payslip or export to Excel to create reports, it is better to add this extra information.

Click “Calc Salary” to calculate payslip.

The salary calculator will calculate EPF, SOCSO, EIS and PCB. Overtime will be calculated based on the OT RATE you set.

The software will also display the amounts used to calculate EPF, SOCSO and PCB. In the example here, the amount used to calculate SOCSO is 3,150 inclusive of overtime which is not included for EPF calculations.

Allowance Settings

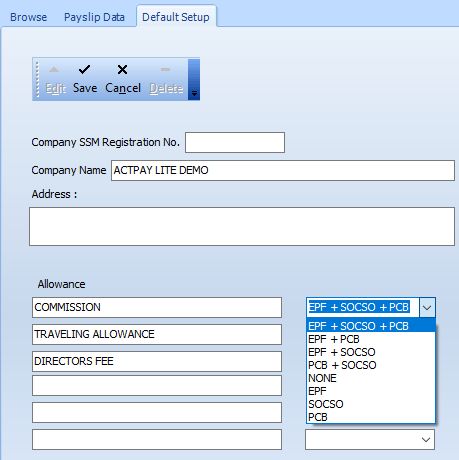

Actpay Salary Calculator has options to add 6 Allowances. These are global settings and the same allowance will appear for all staff.

Go to the Default Setup Screen and click edit.

Each Allowance has 8 options.

- EPF + SOCSO + PCB

- EPF + PCB

- EPF + SOCSO

- PCB + SOCSO

- NONE

- EPF (Only)

- SOCSO (Only)

- PCB (Only)

Choose the right settings for your allowance and Save. For example Commission is subject to EPF, SOCSO, PCB and EIS and Directors Fee is only subject to PCB.

Note that if you choose SOCSO, it will calculate EIS also.

Use the same procedure to add Deductions. There are options for 3 Deductions. For example Loan deduction setting will be NONE. This is because Loan is Staff payment and not wages deduction.

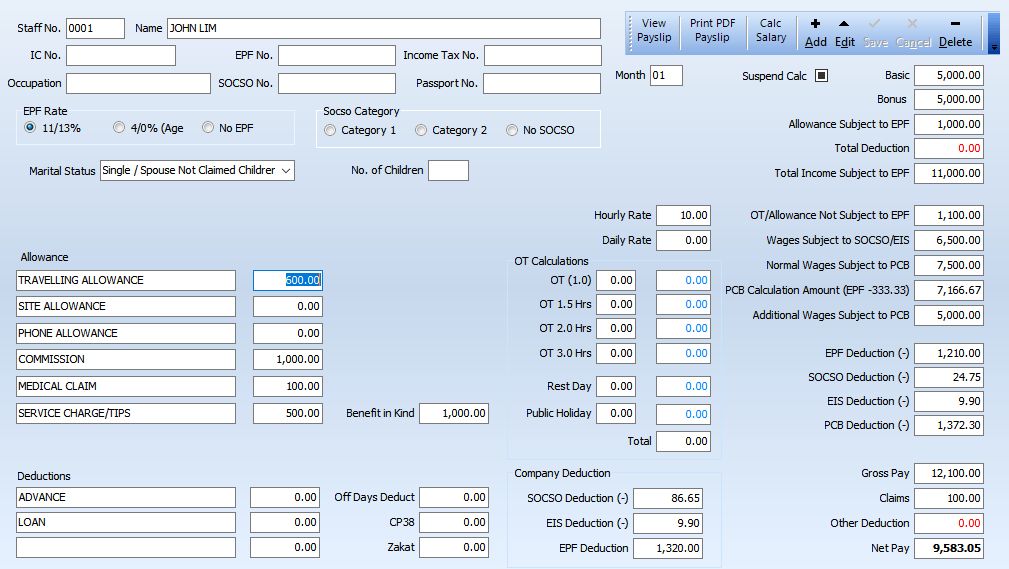

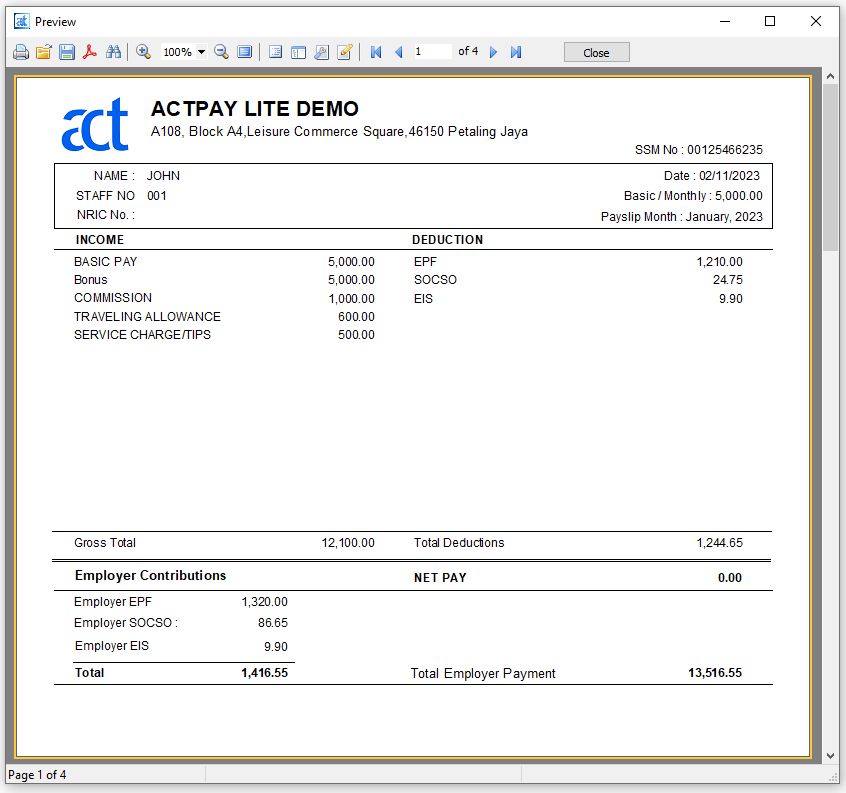

Sample Payslip Calculation

| Basic Salary | 5,000 |

| Traveling Allowance | 600 |

| Commission | 1000 |

| Medical Claim | 100 |

| Service Charge / Tips | 500 |

| Bonus | 5,000 |

| Benefit in Kind | 1,000 |

Explanation of Payslip Calculation

EPF Calculations

Total Income subject to EPF = Basic + Bonus + Commission = 5,000+5,000+1,000 = 11,000

Traveling Allowance is not subject to EPF and SOCSO and not subject to PCB for up to 6,000 per year.

Service Charge/Tips Not subject to EPF.

SOCSO and EIS Calculations

Total Income subject to EIS and SOCSO = Basic + Commission + Service Charge/Tips = 5,000+1,000+500 = 6,500

Please note that Bonus is not subject to SOCSO

PCB Calculations

Total Income (excluding Bonus) subject to PCB = Basic + Commission + Service Charge/Tips + Benefit in Kind

= 5,000 +1,000 + 500 + 1,000 = 7,500.00

Income used to calculate PCB = Total Income – 333.33 = 7,166.67

Note : PCB amount is minus 333.33 based on 4,000 EPF Exemption per year. Per month = 4,000 / 12 = 333.33

PCB for Bonus is calculated as Additional Remuneration using a different formula. You can find the Bonus PCB amount by calculating the same values without Bonus and calculate the difference.

Net Salary = Total Income excluding Benefit in Kind – EPF – SOCSO – EIS – PCB + Claims

= 12,100 – 1,210 – 24.75 – 9.90 – 1,372.30 + 100 = 9,583.05

Please note that PCB calculations in the salary calculator are based on e-CP39 and not e-PCB

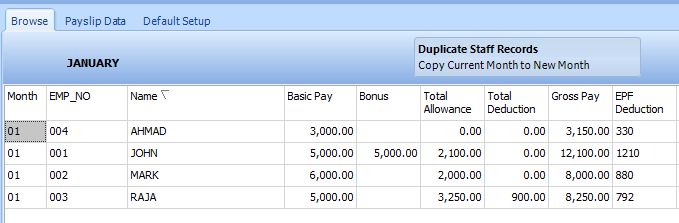

Browse Screen / Filter Month

Click Filter month to choose which month data you want to view. In the above example, filter is set to Month 01. Choose “All” to view all months at the same time.

Click on the Heading to sort the data. In the above example, the staff data is sorted by “Name”

Monthly Procedure.

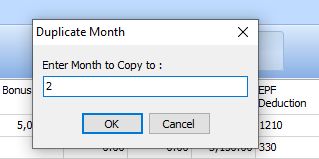

To start 2nd month, Click on “Duplicate Staff Records”

Enter “2” to copy current month data to 2nd Month. Click OK to continue. All the staff records for January will be duplicated and added to Month 02. The month filter will also be updated to Month 02 to view February records.

Go to Payslip data to Edit and Calculate salary as needed.

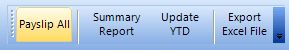

Payroll Reports and Payslip

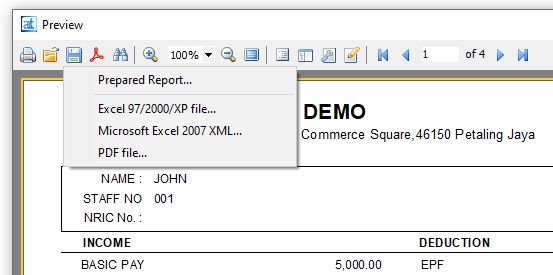

Click Payslip to View payslip report.

To convert Payslip to Excel File or PDF, Click the Save Icon. This same feature is also available for the Summary Report.

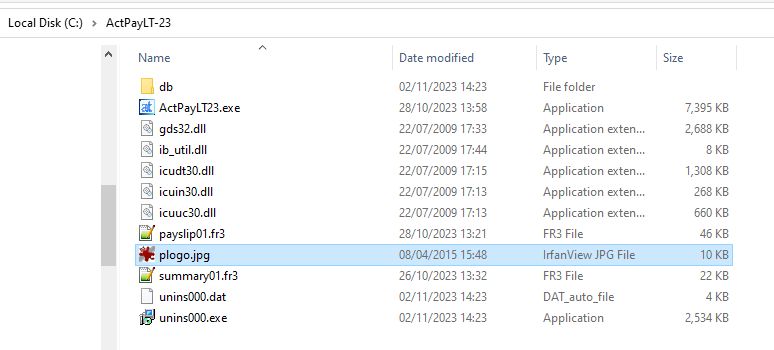

How to Add Logo

To add logo, rename your logo image as “plogo.jpg and copy it to the actpay lite folder. We recommend that the image size is 200 to 300 pixels. Do not use very large images.

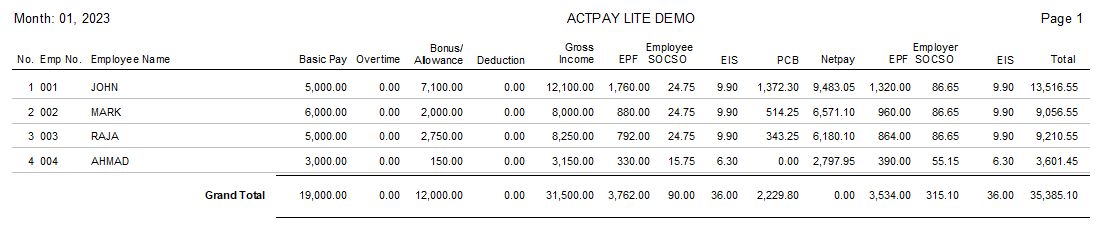

Summary Payroll Report

Summary report has all the basic information needed to manage your monthly payroll, including all the amount totals needed to make statutory payments.

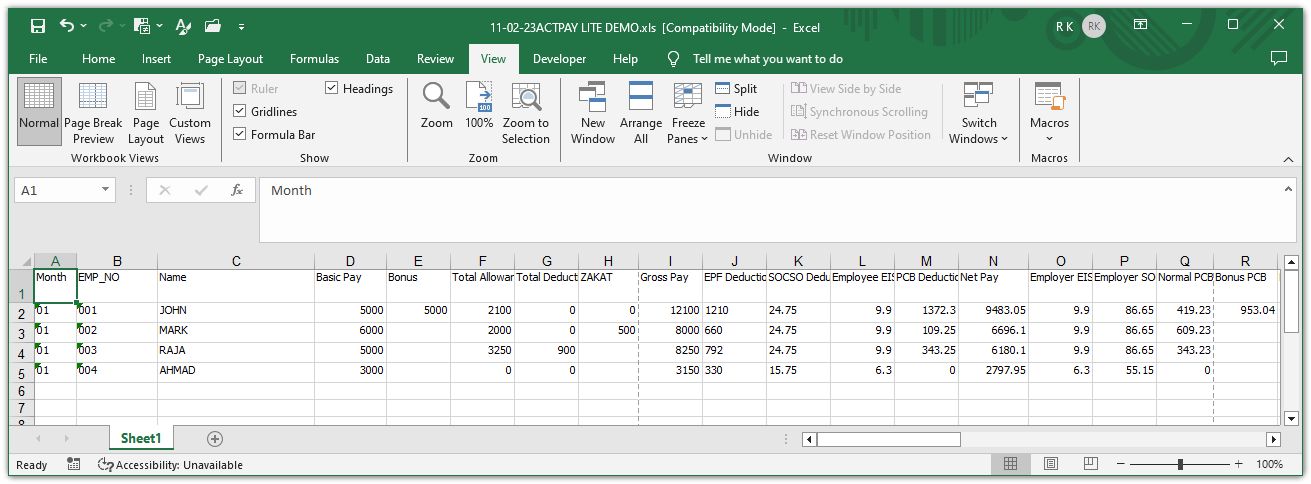

Export Excel File

Click “Export Excel File” in Browse Screen

![]()

File will be created in Actpay Lite Folder. Open and edit as required.

Terms and Conditions.

Actpay Lite Salary Calculator Software comes as is with 6 months of free Updates.

Software can be used for an unlimited time but free updates and corrections are limited to 6 months from date of purchase. Any query can be made on our support page at : https://actpay.com.my/payroll-support-and-questions/

Actpay Lite can only be purchased through Shopee

If the software features found in Actpay Lite are not enough for you, we also have a full fledged payroll software with more advanced features and reports at actpayroll.com.

Some of the extra features found in the full Actpay software are :

- 15 Allowances and 10 Deductions

- 5 Benefit in Kind

- No pay leave calculation

- Track annual leave and medical leave

- Detailed EA Form

- Extensive management reports

- Multiple Payslip formats

You can also download our free salary calculator at this link. This software has most of the features found in Actpay Lite but without Payslip and monthly data.