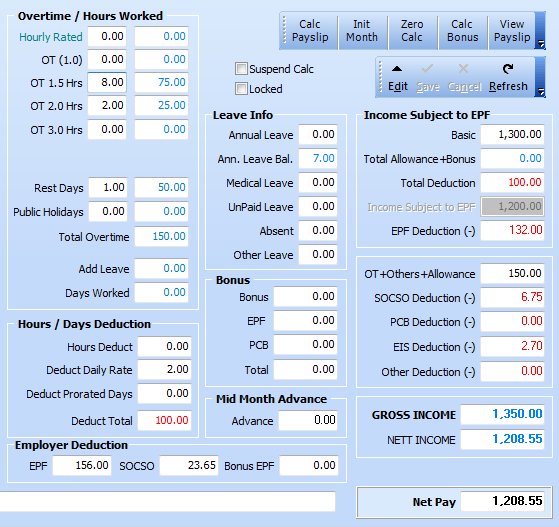

Overtime Calculations

Basic Overtime Calculations

1. Click Edit to go to edit mode.

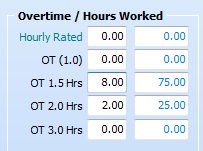

2. Enter OT hours for the appropriate rate.

3. Finally click “Calc Payslip”. This will give the final payslip amount.

Notes :

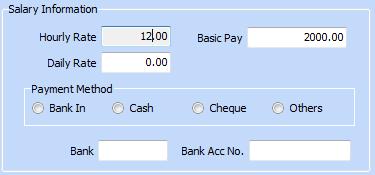

- The Daily rate and hourly rate are based on Basic / 26.

- The default for all staff can be edited in the default screen.

- Individual daily and hourly rates can changed in the personal info screen as follows.

Hourly Rated

This is a special option for daily and hourly rated workers. Entering any value here will calculate the basic pay based on the number of hours worked. The basic pay will be replaced by “hourly rate” x “no. of hours”.

Hourly rate will be based on Basic salary or hourly rate specified in Personal Info Screen.

Overtime Rate Options

- OT (1.0)

i) This entry will calculate hours x hourly rate, but in this case it will be categorized as overtime.

ii) This can be used for cases where employees have contractual overtime rates. - 1.5 Normal day overitme

- 2.0 Rest day overtime exceeding 8 hours

- 3.0 Public Holiday overtime exceeding 8 hours.

Please note rate for Rest days and Public Holidays for Monthly or Weekly rated employee.

Rest day : he shall be paid for any period of work which does not exceed half his normal hours of work, wages equivalent to half the ordinary rate of pay for work done on that day; or (ii) which is more than half but which does not exceed his normal hours of work, one day’s wages at the ordinary rate of pay for work done on that day.

Public Holiday : be paid two days’ wages at the ordinary rate of pay regardless that the period of work done on that day is less than the normal hours of work.

OT Days

Based on the above definition of rest day and public holiday rates, this field should be used for work carried out on rest days and public holidays. The total will be “daily rate” x “no. of days”.

Rest Days

i) This is for calculating rest days worked. The value must be a multiple of 0.5.

ii) The amount calculated is days x daily rate for monthly rated workers and days.

iii) For daily rated workers, it days x daily rate x 2.

Public Holidays.

i) This is for calculating public holidays worked. The value must be a multiple of 0.5.

ii) The amount calculated is days x daily rate x 2 for monthly rated workers and days.

iii) For daily rated workers, it days x daily rate x 3.

Deductions

- Hours Deduct : Deduct “hours” x 1.0

- Days Deduct : Deduct based on formula “daily rate” = basic pay / 26

- Prorated Days : Deduct based on formula “daily rate” = basic pay / no. of days in month. (This option will be available in April 2016 Update)